BlockFi Review: How To Earn Money From Your Crypto In 2021

- Beginner-friendly with one-click trading

- No fees for stablecoin purchases

- Responsive customer service

- Ability to borrow against available crypto asset

- High-interest yield on cryptocurrency deposits

- A limited number of cryptocurrencies available

- Interest rates are not fixed, they vary based on borrower's demand

- Not FDIC or SIPC insurance

There have been a lot of changes to the crypto market since cryptocurrencies first emerged in 2009. Although the core idea behind cryptocurrency was to create a secure and anonymous way to transfer currency from one person/ user to another, things are a lot different now.

Now cryptocurrency traders are usually faced with one of two options, either to accumulate bitcoin or to make a profit in USD.

Due to the high volatility of cryptocurrency prices and also the fear of losing money to trading, many crypto traders would prefer to store their digital assets on a fiat-to-crypto exchange or hard wallet.

Although this strategy of storing digital assets might provide a kind of safety net to traders, it does not accrue any real interest to the initial investment, but then why stay in your comfort zones when there are options like BlockFi that offer some extra coin on top of your initial investment?

In this review we will focus on BlockFi, which serves as a cryptocurrency exchange, savings account and loan service provider all in one, while also offering traders invested in bitcoin or other altcoins a chance to passively earn interest in crypto.

Before we proceed, it is important to note some caveats that guide this review, one of which is time. While we aim to give you the latest information on the Blockfi market, it is important to check their website for any changes before making any decisions.

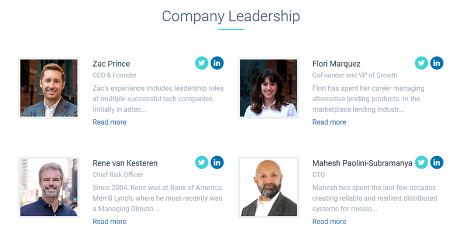

BlockFi is a global trading platform founded in 2017 by Zac Prince and Flori Marquez offering services like interest accounts, crypto-backed loans, and crypto trading to both individuals and institutions.

Although BlockFi is an independently owned lender, they have secured backings and investment from renowned financial establishments like SoFi, Galaxy Digital, Coinbase Ventures, Fidelity, Morgan Creek Capital, and ConsenSys Venture

Who Is Behind BlockFi?

BlockFi was founded in 2017 by Zac Prince and Flori Marquez. The Founder and CEO, Zac prince has shown outstanding leadership in very important roles in the tech world. While at one of the tech companies, adtech, he was part of the successful acquisition of Admeld by google.

Flori Marquez, the cofounder is a Cornell University graduate and has built and optimized a $125 million portfolio for Bond Street in the west end of London. Most of her career path is targeted at managing alternative lending products.

How Does BlockFi Work?

Although BlockFi is a cryptocurrency exchange and wallet that offers individuals and businesses an interest-earning platform or a platform to store or fund their account with USD, crypto or stable coin, it goes beyond mere crypto exchange services.

Unlike other crypto exchange platforms blockfi is primarily a cryptocurrency lender.

The two main features BlockFi offers are the BlockFi Interest Accounts and crypto-backed loans, which works by lending out your crypto at high interest rates to institutional or business borrowers.

It is the high-interest payments made by these big borrowers that keep BlockFi running.

BlockFi would keep a percentage of the interest payments by these big borrowers and share some of it with users who opened interest accounts or took out loans.

It is quite simple for users to get loans too, you give your crypto assets including bitcoin ethereum or litecoin and in turn, you get a loan in USD, stable coin, Gemini dollar (GUSD) or US dollar stable coin.

Top Features Of BlockFi You Should Know

| Top Features Of BlockFi You Should Know | |||

|---|---|---|---|

| Fees | Approximately 1% spread per trade. | ||

| Supported Transactions | Trading, buying, selling, exchanging, withdrawing | ||

| Currencies Offered | 10 different crypto tokens | ||

| Wallet Encryption | AES-256 encryption and allow listing | ||

| Mobile Apps | Android and iOS |

Who Can Use BlockFi?

BlockFi is available to anyone aged 18 or more, can act on their own and form a binding contract with BlockFi.

BlockFi is also available to users in all 50 US state and international locations, except those sanctioned by the US. In addition, there are some state to state variations to access BlockFi products. For example, the BlockFi interest account is not available for New York residents and USDT is only available to those in international locations as a stable coin trading pair. So it is important to find out the terms and conditions for your location.

IS BLOCKFI SUITABLE FOR BEGINNERS?

BlockFi is suitable for beginners. Its mobile app and website are easy to navigate even for first-time investors. BlockFi also offers advice about paying crypto taxes or understanding loan terms rather than simply offering resources geared toward crypto learning.

They also offer great customer support through live chat, email or phone customer support and many questions are answered within 24 hours.

WHAT CRYPTOCURRENCY CAN YOU TRADE ON BLOCKFI?

BlockFi lets you buy, sell or exchange 6 popular cryptocurrencies including BTC, LTC and ETH And 4 USD Based Stable Coins including USDC, GUSD, PAX and USDT

Here are some ofthe cryptocurrencies you can trade on BlockFi:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Paxos Standard (PAX)

- Chainlink (LINK)

- PAX Gold (PAXG)

- Gemini dollar (GUSD)

- USD Coin (USDC)

- Tether (USDT)

- Binance USD (BUSD)

IS BLOCKFI SAFE?

BlockFi or rather BlockFi licensed custodian, Gemini, is not insured by bank-like security like SPIC or FDIC.

However, BlockFi takes some security measures to keep your funds safe. One of such measures is that clients funds are placed ahead of any equity or employee funds in the event of a loss. In addition, only a small portion of its client funds are kept in 3rd parties accounts like Gemini and coinbase for withdrawals, the majority of funds are offline i.e cold storage. It also includes additional security with the Two Factor Authentication (2FA) to protect your account.

IS BLOCKFI LEGIT?

BlockFi assets have been under general scrutiny by the public and investors alike, and this is understandable because as the world becomes more and more unified via the internet, the probability of losing money through assets you do not fully understand increases daily.

However, this is not the case for BlockFi, as all BlockFi assets are legit and available to any interested investor around the world. The funds at BlockFi are held by the Gemini Trust Company, which in turn is regulated by the New York Department of Financial Services.

Investors in BlockFi can also withdraw their assets at any given point in time. This helps to increase the convenience of investment, dealing with cryptocurrency and also reduces the risks one would face when dealing with cryptocurrency.

PRODUCTS AND SERVICES

The core products BlockFi offer include:

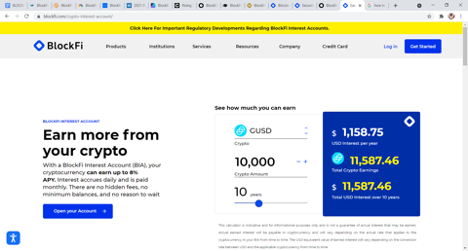

BlockFi interest account: With a BlockFi interest account your cryptocurrency can earn up to 8% APY. This interest accrues every day and you are paid at the end of each month and there are no hidden charges.

Trade account: you can buy, sell or exchange popular cryptocurrencies likeBTC, LTC and ETHat competitive prices and earn interest immediately after you start trading.

Crypto backed loans: borrow against your portfolio as BlockFi lets you borrow funds in USD against your crypto assets with interest rates as low as 4.5%, while you continue to hold. So you don’t have to sell your crypto to get cash.

BLOCKFI INTEREST ACCOUNT

The BlockFi interest account provides crypto investors who store their crypto at BlockFi a chance to earn a monthly compound interest while still holding their cryptos. The interest starts accruing the day after you fund your account and you can withdraw at the end of each month.

There are no restrictions on withdrawal so you can withdraw at any time. It is important to note that with your BlockFi account you are entitled to one free crypto withdrawal and one stable coin withdrawal per calendar month. Any other withdrawal would incur withdrawal fees which vary depending on the coin.

In addition, it is important to note that the interest rate, withdrawal limits, and fees are subject to change.

WHAT IS THE INTEREST RATE?

The interest rate on the BlockFi interest account is based on the yield generated. Interest on all assets follows a tiered interest structure and varies for each coin supported by BlockFi.

| Currency | Amount | APY | |

|---|---|---|---|

| BTC (Tier 1) | 0 - 0.10 BTC | 4.5% | |

| BTC (Tier 2) | 0.10 - 0.35 BTC | 1.0% | |

| BTC (Tier 3) | > 0.35 BTC | 0.1% | |

| ETH (Tier 1) | 0 - 1.5 ETH | 5% | |

| ETH (Tier 2) | 1.5 - 50 ETH | 1.5% | |

| ETH (Tier 3) | > 50 ETH | 0.25% | |

| LTC (Tier 1) | 0 - 20 LTC | 4.75% | |

| LTC (Tier 2) | > 20 - 100 LTC | 1% | |

| LTC (Tier 3) | > 100 LTC | 0.1% |

WHEN DOES THE INTEREST PAYMENT GO OUT?

Interests accrued are usually paid on the last business day of the month. On the first day of each month, your estimated accrued interest resets. You would usually be notified via email when your statement is available.

- Here are the steps to check your interest accrued.

- Log in to your BlockFi account

- Click on the name in the top right of your screen and select ‘report’

- Under earnings set the year

- Select the month you are looking for and download.

BLOCKFI TRADING ACCOUNT

BlockFi allows clients to buy, sell and exchange popular cryptocurrencies like BTC, ETH, LTC AND PAXG and stable coins USDC, USDT, PAXG and GUSD. interest earned on trading is immediate, you earn as soon as a trade is submitted.

How to trade using the BlockFi trade account

- Go to the BlockFi website to sign up or download the BlockFi Android or iOS application.

- Upload your personal information and documents and then accept the terms and conditions after you’ve entered all the information

- As part of the KYC/AML process, you will need to provide proof of identity.

- To deposit funds into your account, go to the Deposit tab and select Bank Transfer, Cryptocurrency or Stable Coin Transfer from the drop-down menu.

- The interest begins to accrue as soon as you deposit the money. Remember that you can also use it as collateral to get a loan or trade it for other approved cryptocurrencies and stable coins.

CRYPTO BACKED LOANS.

BlockFi also gives its clients a great opportunity to make new profits without having to sell their digits assets. The BlockFi platform offers their clients a chance to borrow funds at rates as low as 4.5% APY against their cryptocurrency asset.

The amount available to borrow is dependent on two factors, one of which is the amount of collateral you post against the loan and the other is LTV (loan to value ratio).

The loans offered at blockFi are all structured as 12 monthly interest-only loans, and you pay back an origination fee of 2% due when the loan is paid in full.

The payment method used when acquiring a loan also determines what timeframe you will receive your collateral. There are 3 main methods of payment available, this includes paying by crypto, paying by wire transfer, and paying by ACH transfer.

For international loans, there are two options of payment; Full payment and Partial payment. In the full payment option, you pay off the entire loan at once, while the partial payment you can pay the portion

When the loan is fully paid off, your collateral will be transferred to your interest account where you can use it to trade.

How Easy Is BlockFi To Use?

The website and mobile app are easy to use and beginner-friendly. The mobile app centralizes the management of the products BlockFi offers like the interest account, trade, and loan, making it easier to use

Customer care is also very responsive and this further heightens the user’s experience.

SAFETY FEATURES

- Most digital assets are kept with third parties like Gemini, BitGo and coinbase in cold storage and the rest in hot wallets that are insured by Aron

- It provides insurance coverage for digital assets to meet the SOC 2 Type 1 security compliance.

- There include Two-Factor Authentication (2FA) to protect withdrawals and logins

- Use of hardware security keys and Web Authorization for account security

- It uses allowlisting to ensure that cryptocurrency in your BlockFi account can only be sent to known withdrawal addresses.

- It is encrypted to secure passwords, personal information and other sensitive information.

FEE STRUCTURE AND PRICING

For users with the BlockFi interest accounts, there is no minimum balance required to earn interest, however, accounts are subjected to Gemini’s withdrawal minimum of 0.003 for BTC and 0.056 for ETH.

In addition, the fee structure differs from coin to coin. BlockFi clients withdrawal of BTC is subject to a maximum withdrawal of 100 BTC per 7 day period, while ETH withdrawals are subjected to a maximum of 500ETH per 7-day period.

| Currency | Withdrawal Limit | Fees | |

|---|---|---|---|

| BTC | 100 BTC per 7-day period | 0.00075 BTC | |

| ETH | 5,000 ETH per 7-day period | 0.02 ETH | |

| LINK | 65,000 LINK per 7-day period | 0.95 LINK | |

| LTC | 10,000 LTC per 7-day period | 0.0025 LTC | |

| Stablecoins | 1,000,000 per 7-day period | $10.00 | |

| PAXG | 500 PAXG per 7 day period | 0.015 PAXG | |

| UNI | 5,500 UNI per 7 days period | 1 UNI | |

| BAT | 2,000,000 BAT per 7 day period | 35 BAT |

BlockFi CUSTOMER SERVICE

Blockfi offers a comprehensive and highly responsive customer support service to its clients. The help centre divides its services into different sections. These include general, BlockFi interest account, BlockFi trading, BlockFi, and BlockFi bitcoin rewards.

In these sections, they offer practical guides, detailed articles and other resources that could help customers troubleshoot their problems on their own. There are other options for customers that are unable to find adequate information in the help section, such customers can contact BlockFi either through social media or by submitting a ticket. In most cases, clients get a response within 24hours.

BlockFi FAQS

How Long Does Account Verification Take?

Signing up at Blockfi is quite easy, and in a few minutes, your application would be approved once you upload all the right government IDs required and complete your know your customer (KYC). If however, after 48 hours, your account application is still pending,then reach out to them by scrolling to the help centre page and clicking on the chat icon in the bottom right corner of the page

How Do I Enable 2FA On My BlockFi Account?

To enable 2FA on your Blockfi account, select ‘profile settings’ by logging into the client dashboard and clicking on your name at the top right of the screen. After this, click on the “security” tab and scroll to the “two-Factor Authentication” section and then finally click the“ Enable 2FA” to get started.

To complete the process, follow the following instructions.

- Scan the QR code below with the Google Authenticator app or manually enter the Authenticator token code.

- In the Authenticator app, you’ll see a 6-digit code called BlockFi, with your account email in parenthesis. A 6-digit BlockFi verification number will be generated by Google Authenticator. Every 30 seconds, a new code will be generated.

- In the “Enter One Time Code”window, enter the BlockFi verification code from the Authenticator app.

- Select next

- Make a note of the recovery code that can be used to regain access to your 2FA account. This should not be saved to your computer. If you ever lose access to your smartphone, BlockFi can also reset your 2FA code.

- Click the checkbox to confirm that you have saved the recovery code.

- Click continue and you are done.

Is Blockfi Available In Australia?

BlockFi supports customers from all over the world including Australia providing crypto-backed loans, a trading account and a crypto savings account, with a Bitcoin Credit Card on its way. Residents can transfer digital assets on an Australian crypto exchange and deposit them in BlockFi to start earning.

What Happens To My Asset If I Pass Away?

In the event of death, BlockFi will follow applicable law depending on your state and will ensure they adhere to your end of life wish.

CONCLUSION

Cryptocurrency is an ever-growing and bustling market, and despite the steep rises and falls, it is a modern phenomenon that is here to stay, and so is BlockFi.

BlockFi makes trading and earning crypto assets as well as navigating the usually confusing cryptosystems easy even for investors, enabling one to harness the massive potential the cryptocurrency market has.

Therefore it is best and advisable to guard one’s cryptocurrency portfolio and increase one’s handling of the market using BlockFi for seamless transactions and user experience as well as possessing solid institutionalised financial and legal backing.

Other Reviews

Quick Links

Legal Stuff